what is a tax lot number

Forest Products Harvest Tax FPHT How forestland is taxed in Oregon. Your local tax office and city.

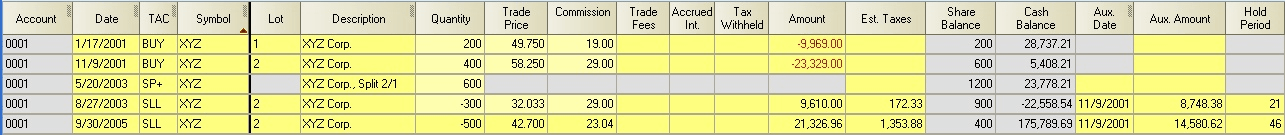

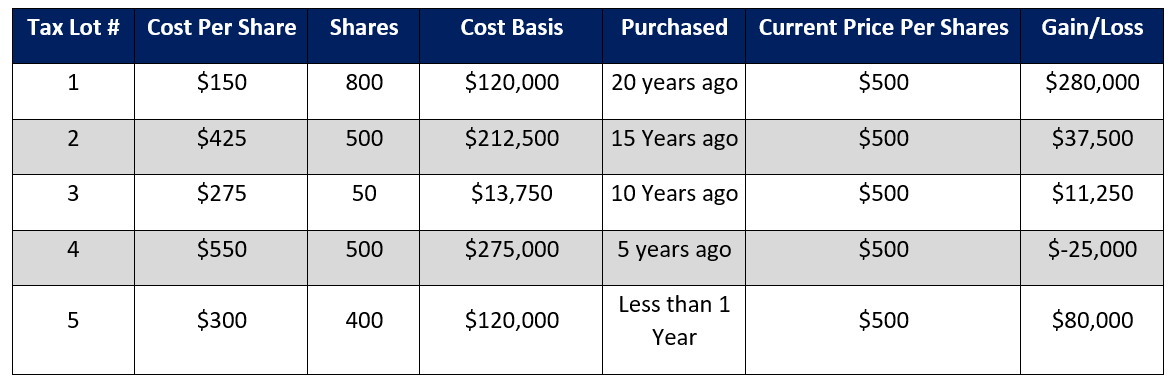

Tax lot accounting is a method of record keeping that tracks the cost purchase date and sale date for every unit of every security in a portfolio.

. In this case lots A B C and D would all result in taxable profits. A tax lot is a record of the details of an acquisition of a security. However selling Lot E would result in a loss of 004 per share or 80.

A lot number is an identification number assigned to a certain quantity or group of products from a single manufacturer. A tax lot is a record of the details of an acquisition of a security. The X represents the Sheet or Map number.

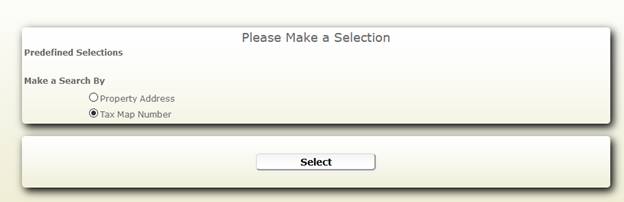

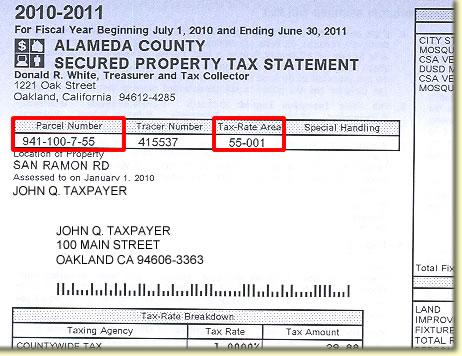

A type of the Lot and Block system is frequently used for tax identification purposes in the United States. This is the number that shows several properties on. How Does Tax Lot Accounting.

Each acquisition of a security on a different date or for a different price constitutes a new tax lot. Tax maps are usually broken down into 3 numbers such as XXXXX-YY-ZZ. Because this loss would actually help to lower.

Each acquisition of a security on a different date or for a different price constitutes a new tax lot. A tax lot is a record of a transaction and its tax implications including the purchase date and number of shares. A tax lot may also be a lot or parcel when created at a property owners request for.

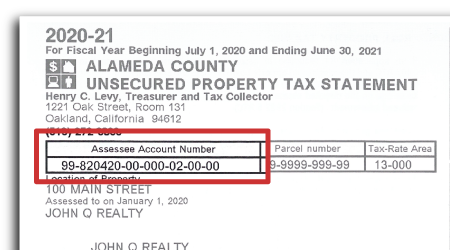

Every parcel on a tax map is assigned a parcel number. A parcel number is assigned by your local tax assessment office and is used to help identify your property for tax title deed and property line reasons. Your local tax office and.

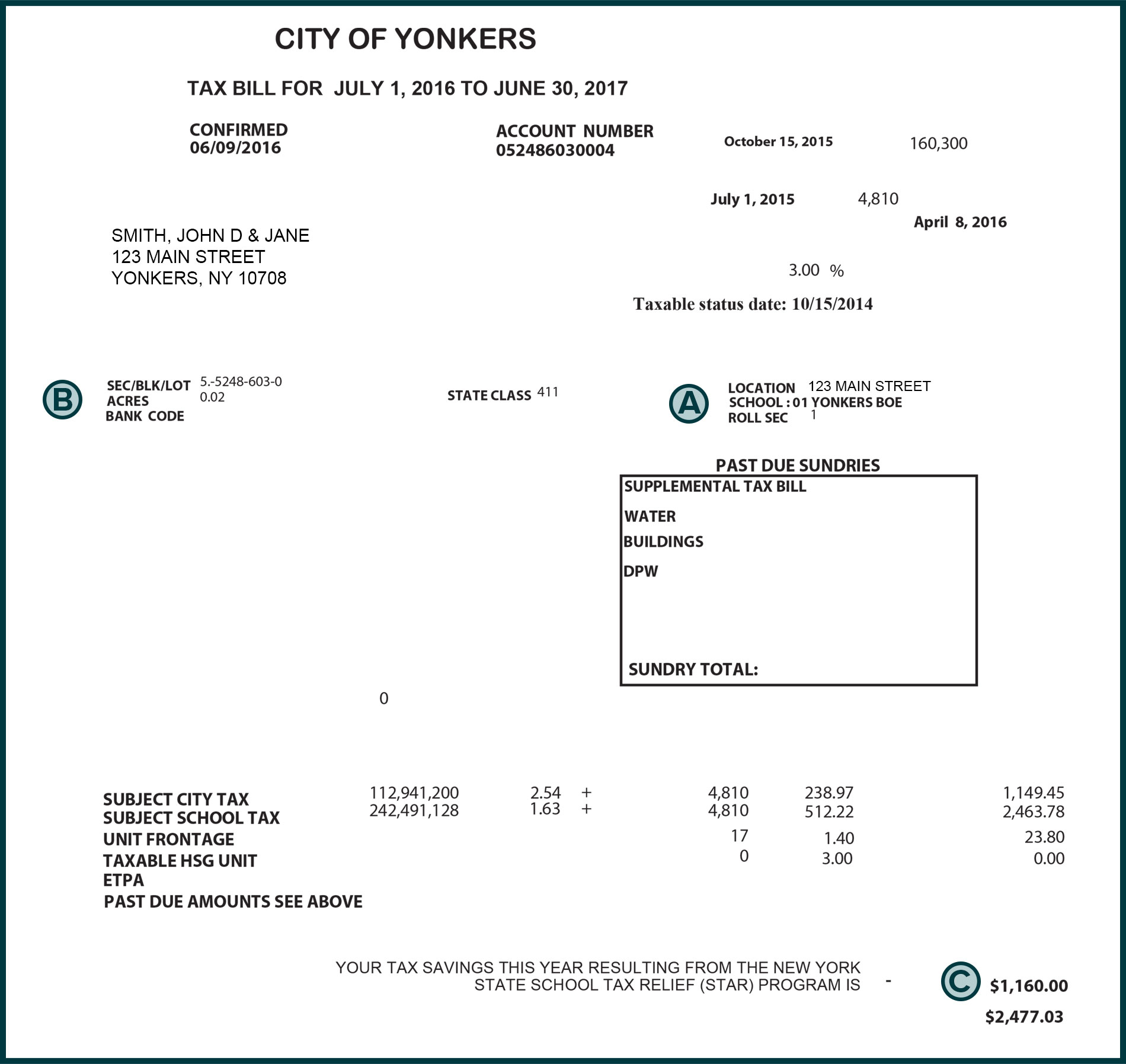

2021 harvest tax rates. A parcel number is assigned by your local tax assessment office and is used to help identify your property for tax title deed and property line reasons. The first digit is the numerical representation 1 to 5 of the borough the next five digits are the city Block and the last four digits are the Lot.

A lot number is a unique identifier assigned to a batch of items. Each acquisition of a security on a different date or for a different price constitutes a new tax lot. A tax lot is a record of all transactions and their tax implications dates of purchase and sale cost basis sale price involving a particular security in a portfolio.

A Tax Identification Number TIN is a nine-digit number utilized as a tracking number by the Internal Revenue Service IRS. Notification of operation permit 2022 harvest tax rates. The BBL is composed of 10 digits.

Tax lot plural tax lots accounting taxation US A grouping of security holdings in an account used for enabling the calculation and treatment of the securities for tax compliance. A tax lot is a record of the details of an acquisition of a security. Lot numbers are used to track items throughout the manufacturing process and can be used to identify recalled.

It is required data on all tax returns recorded with the IRS. Tax Lot means a parcel lot or other unit of land as created by the county assessor for the purpose of taxation. This designation often called a Tax Identification Number or Tax Parcel Number is not.

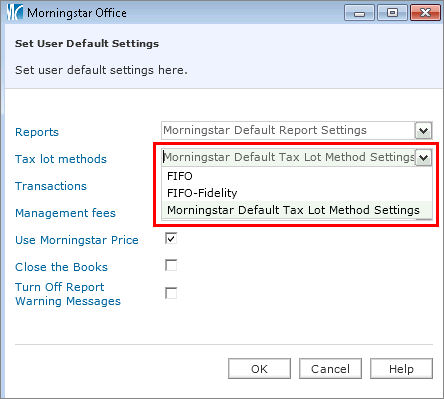

What Happens To Loss Harvesting Under Fifo

What Is A Tax Lot With Picture

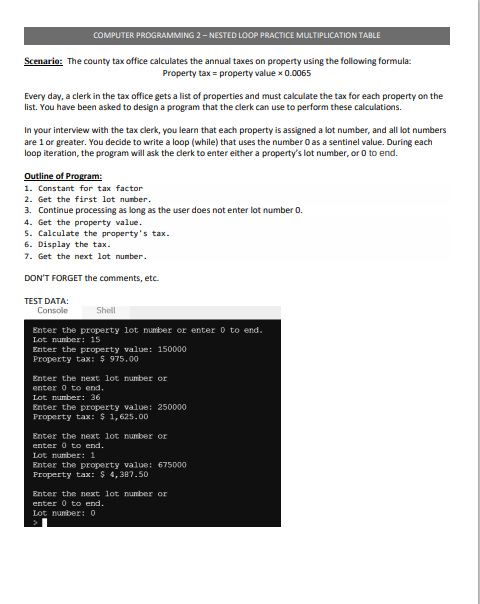

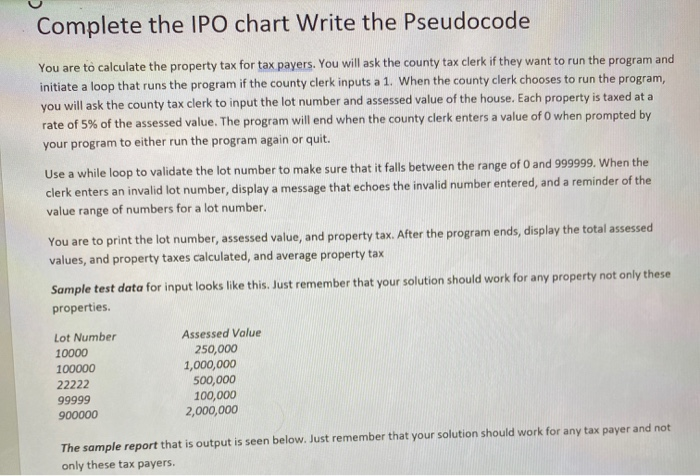

Solved Computer Programming 2 Nested Loop Practice Chegg Com

Examination Of Title To Lot Number Ten Block Number Thirty Two Of Del Mar Terrace The Portal To Texas History

Understanding Your Property Tax Bill Clackamas County

Ministry Of Finance Jamaica On Twitter How To Determine Your Property Tax Jamaicatax Onthegroundjm Jisnews Nationwideradio Cliffnationwide Geordavis Caribbeannewsuk Https T Co Agglecznng Twitter

154 21 Cryders Lane Queens Ny 11357 Compass

Bol Demo Unrealized Expanded Tax Lots

Nyc Real Estate Taxes Blooming Sky

Tax Lot Optimization Why It Matters To Investors Level Financial Advisors

03s4508 Tax Lot 1100 Wallowa Lake Or 97846 Realtor Com

Tax Maps Real Property Tax Services

Solved Complete The Ipo Chart Write The Pseudocode You Are Chegg Com